A complete guide to who controls Russian news. [Note: Read part one here.]

Due to the constrained political environment, Russian media outlets were unable to resist the pressure from the state and succumbed to the well-known propaganda and conformism pattern, according to which they had been operating in during Soviet times. The period of relative freedom of the press ended with Vladimir Putin's ascension to power. This was too short a time-span for Russian media to become a strong democratic institution and watchdog.

Patterns of Conformism

It is noteworthy that today's situation differs from Soviet times. Russia is no longer a closed country; Russian media outlets are exposed to the free-flow of information and developments of the global media market; and Russian journalists are aware of the media's role in the free world.

Therefore, by choosing to serve as propaganda tools to receive benefits from the state and by abandoning their public duty to report the truth, most of the media voluntarily decided to engage in corrupt practices.

Deterioration of public political discourse is a direct result of the lack of political pluralism and competition. As it happens in all closed regimes, political discourse in Russia transformed from open political communication into the state's narrative. As a result, the content of political discourse became flat and dull.

Considering general disillusionment of Russian citizens in politics and in their own abilities to influence the political process or bring about change, public interest shifted from politics to the entertainment segment, which drives the expansion of the entertainment industry.

Another reason for this expansion is the commercialization of the global media market, driven by the advertising industry and aimed at stimulating consumption. As mentioned above, the diminishing political discourse created an information vacuum in Russia that, with a lack of alternatives, had been filled with entertainment content. Eventually, this process led to the tabloidization of the press and the prevalence of popular media formats that appeal primarily to the masses.

The outlook for the Russian media market provides an insight into the type of information that Russian media produces and what the public consumes. It shows entertainment content has filled the empty niche of political programming.

At the same time, while political and investigative journalism is declining in Russia, the Russian media market is booming due to the high inflow of advertising money. Today, Russia ranks ninth in the top ten media markets in the world and, in 2013, its market growth rate was estimated to be at 12% — the highest rate across the top ten media markets (see Table 1).

Table 1. Top 10 Media Markets

Source: Aegis Global Report

*Compared to 2011; **Compared to 2012

According to Aegis Global Report, the high growth rate of the Russian media market is driven by the expansion of the advertising market, especially in the premium sector (companies with an annual advertising budget of more than 3 billion rubles, or $100,000). Industries, such as medicine and IT, have demonstrated the highest growth of 18% and 13%, respectively. The 2014 Sochi Olympic Games was expected to give the market an additional boost.

Television

The ownership structure of the Russian media market shows that national media outlets with the highest audience reach are controlled by the state — primarily television.

Television in Russia is the leading source of information. Around 99% of Russian households have at least one TV-set, and about 94% of Russians watch television on a daily basis. The core of the TV market consists of 19 federal channels available to more than 50% of the population.

Russian television is a mixture of two models: one is state-controlled (major TV channels are either owned by the state or by businessmen and companies loyal to the state). The other model is purely commercial, which provides entertainment content. Regardless of the ownership structure, Russian television is mostly financed through advertising and sponsorship.

All three main TV channels are controlled by the state. The majority share of Channel One belongs to Rosimuschestvo (the Federal Agency for State Property Management). Other shareholders include National Media Group — controlled by the structures of Yuri Kovalchuk, chairman of the board at RossiyaBank and President Putin's personal friend; and Roman Abramovich, owner of Chelsea Football Club and Putin's ally.

Rossiya 2 is part of VGTRK (All-Russia State Television and Radio Broadcasting Company), which is owned by Rosimushchestvo. NTV is also controlled by the state through Gazprom Media.

TNT and Pyatiy Kanal, who come respectively fourth and fifth in the top TV channels by audience reach, are also controlled by the state. TNT belongs to Gazprom Media, while Channel 5 is controlled by National Media Group.

Print Press

According to a recent report by the Russian Guild of Press Publishers, the total circulation of print media outlets in Russia is around 7.8 billion copies, including 2.7 billion national dailies, 2.6 billion of regional, and 2.5 billion of local press.

Similar to the television industry, the press market is divided between the two media models: quality dailies and weeklies that are mostly business oriented and have relatively small readership; and popular newspapers and magazines that are inclined to tabloidization.

For the last five years, the share of print press has been steadily decreasing. In the first half of 2013, the circulation of national newspapers and magazines went down by 7.5%, while its market share shrank by 6%. The main reasons were the recession following the 2008 financial crisis, growth of Internet media, a ban on advertising alcohol beverages, and the expected ban of advertising tobacco products (projected to come into force in 2014). Tobacco and alcohol companies were among the major contributors in the print market's profits.

The structure of the print press market is much more diverse in terms of ownership, but publications with entertainment content, glossy fashion magazines and tabloids are dominating the market.

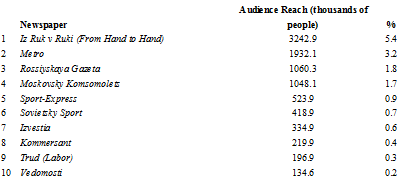

The results of a 2012 TNS survey on the audience reach of Russian publications presented in Table 2 reveal a number of current trends: the newspaper with the largest audience reach in Russia is a classified daily, Iz Ruk v Ruki; it is followed by Metro, a free daily intended primarily for commuters; and the third is Rossiyskaya Gazeta, an official source of political information provided by the state and owned by Rosimushchestvo. Out of the top ten outlets, only two newspapers provide quality political/business content — Kommersant (8th) and Vedomosti (9th) — while other newspapers cover the entertainment sector.

It is noteworthy that Izvestia, a well-known, respected Soviet brand, was acquired by the National Media Group in 2011. The new owners pronounced it to become a state-controlled competitor of Kommersant and Vedomosti.

Izvestia covers Russian politics, but as one of its owners and editor-in-chief, Aram Gabrelyanov, stated in an interview, the newspaper has three forbidden topics: the president, prime minister, and patriarch.

Another detail that needs to be mentioned is that even though Kommersant gained its reputation as the first independent quality daily in Russia, in 2006, it was acquired by Alisher Usmanov, head of Metallinvest Management Company. Usmanov was ranked first in the Forbes Top-200 Richest Businessmen in Russia in 2013, and openly supports Putin.

In the context of the Russian political system, such ownership suggests that Kommersant's coverage of politically sensitive issues can be managed by application of the so-called "administrative resource" — in other words, pressure from the Kremlin.

Table 2. Top Dailies in terms of Audience Reach* (Russia)

Source: TNS Russia, NRS, 2012

* Komsomolskaya Pravda did not participate in this survey, but according to the public data, its daily circulation is around 655,000 copies; the Friday edition is 2.7 million.

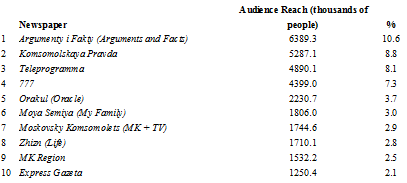

Table 3 provides evidence that Russian readers lack interest in political issues. All top ten weeklies with the largest audience reach in Russia are either popular publications with mass appeal (Argumenty i Fakty, Komsomolskaya Pravda, Moya Semiya) or are tabloids (Zhizn, Express Gazeta).

Weeklies that provide serious analysis of current political issues are scarce on the market. Few examples are Kommersant-Vlast, Expert, and The New Times. But the first two magazines are owned by oligarchs who openly support the Russian president. Kommersant-Vlast is produced by Kommersant Publishing House that, as mentioned above, is owned by Usmanov. Expert is part of Expert Media Holding that is owned by Oleg Deripaska's Basic Element and a Russian state corporation: Vnesheconombank.

Table 3. Top Weeklies in terms of Audience Reach* (Russia)

Source: TNS Russia, NRS, 2012

At the same time, audience preferences across Russia differ from those in large cities. Table 4 shows this difference for Moscow's audience.

Moskovsky Komsomolets is the second most popular newspaper in Moscow. Even though the newspaper has mass media appeal and tends to lean toward a tabloid style, sometimes it publishes sharp political commentaries. The newspaper is owned by Editor-in-Chief Pavel Gusev, who also holds several official positions such as head of the Moscow Union of Journalists, member of the Presidential Human Rights Council, and member of the Russian Public Chamber. Still, private ownership of the newspaper allows for certain freedom in terms of political discourse.

Another difference is that Novaya Gazeta appears eighth in the top ten most popular newspapers in Moscow. Novaya Gazeta is one of very few newspapers on the market that produces high-standard pieces of investigative journalism. It is owned by members of the editorial board, while minority shares belong to Russian businessman Alexander Lebedev and former Soviet President Mikhail Gorbachev.

Table 4. Top Dailies in terms of Audience Reach* (Moscow)

Source: TNS Russia, NRS, 2012

Radio

Radio is the growing segment of the Russian media market. According to Elena Vartanova, the main reasons for the increase in radio stations are advancements in broadcasting of commercial music and fragmentation of the audience. The Aegis Global Report shows that, in 2012, the radio industry of the advertising market in Russia increased by 23%; but in the first half of 2013 the growth slowed down to 14%.

Most Russian radio stations broadcast music and entertainment content. According to a 2012 VTsIOM survey, Russkoye Radio is the most popular radio station in Russia, followed by Europa Plus and Autoradio. Out of 15 radio stations that are listed in the ranking, only three broadcast political talk shows: Mayak, Radio Rossiya, and Ekho Moskvy.

Mayak and Radio Rossiya are state-owned (Rosimushchestvo), while Ekho Moskvy is owned by Gazprom Media. Still, Ekho Mosvky allows for members of opposition to participate in some its programs and to voice criticisms of the regime.

Table 5. Most Popular Radio Stations

Source: WTsIOM, 2012

Internet

The Internet market in Russia shows a positive dynamic. In the first half of 2013, Internet advertising grew by 30%, which is the highest increase across all media.

The rise in the Internet share has been quite dramatic. In 2007, the share of Internet in the Russian media market did not exceed 3%, while by 2012 it amounted to 19%. Over the same period, the share of the print press dropped by 9% and radio by 3%, while the share of television decreased by 1%.

However, it is noteworthy that the share of Internet grows not only because new users acquire access to the net, but also due to the increase in the number of connection points. Today, every fourth Internet user in Russia has three or more devices connecting them to the web. Meanwhile, the number of Russian citizens who have access to Internet hardly exceeds 50%.

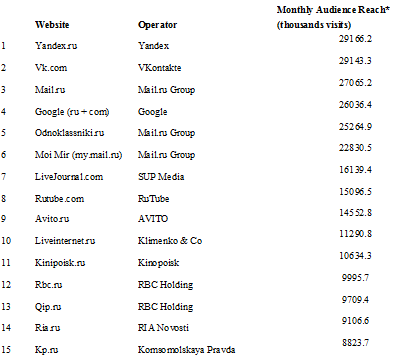

Table 6 shows the most popular websites of the Russian Internet (RuNet) by their audience reach. Yandex tops the list, being the most popular Russian search engine and accumulating 34 websites on its platform. Yandex's primary competitor, Mail.ru, comes third but two other websites of the Mail.ru Group (odnoklassniki.ru and Moi Mir) are rated fifth and sixth.

Table 6. RuNet's Most Popular Internet Websites

Sources: TNS, Tasscom, March 2012

Popular Internet media (as opposed to Internet search engines and social media) are at the bottom of the Top 15 list. Rbc.ru and Qip.ru belong to a privately owned RBC Holding, while Ria.ru is an Internet platform of RIA Novosti, a state-owned news agency. Kp.ru is part of Komsomolskaya Pravda Holding and is owned by ESN Group, associated with a state transportation company: Russian Railways.

Today, Russian Internet is quite diverse in terms of forms of ownership, which allows for greater freedom of expression and variety of information sources.

*[A version of this article was originally published by The Interpreter.]

The views expressed in this article are the author's own and do not necessarily reflect Fair Observer’s editorial policy.

Image: Copyright © Shutterstock. All Rights Reserved

Support Fair Observer

We rely on your support for our independence, diversity and quality.

For more than 10 years, Fair Observer has been free, fair and independent. No billionaire owns us, no advertisers control us. We are a reader-supported nonprofit. Unlike many other publications, we keep our content free for readers regardless of where they live or whether they can afford to pay. We have no paywalls and no ads.

In the post-truth era of fake news, echo chambers and filter bubbles, we publish a plurality of perspectives from around the world. Anyone can publish with us, but everyone goes through a rigorous editorial process. So, you get fact-checked, well-reasoned content instead of noise.

We publish 2,500+ voices from 90+ countries. We also conduct education and training programs

on subjects ranging from digital media and journalism to writing and critical thinking. This

doesn’t come cheap. Servers, editors, trainers and web developers cost

money.

Please consider supporting us on a regular basis as a recurring donor or a

sustaining member.

Will you support FO’s journalism?

We rely on your support for our independence, diversity and quality.

Comment