Cryptocurrencies, also known as “crypto,” are the most new and abstract forms of money ever. They are burdened with many question marks, from superficial observations to deep mathematical problems.

First of all, how could anyone trust something named “crypto”? Those syllables connote mysterious, secret, hidden and locked up. The very opposite of trustworthy.

Second, look at the people selling it. Not how they looked years ago, fresh-faced, energetic, and eager to disrupt stodgy governments and banks. Believable. Their story, originally inspired by anarchism, made the growth of crypto seem inevitable, and good. But that’s a self-reinforcing story, as the book Narrative Economics” by Nobel Prize–winning economist Robert Shiller explains. Stories of inevitably growing wealth, like the famous Dutch tulip mania, disrupt economic common sense. The book calls these stories “narrative contagions”, because their inherent promise makes them spread all by themselves. The rise of Bitcoin is the first and best example of a narrative contagion.

But stories lauding crypto aren’t believable any more. It turns out, for example, that prominent crypto-booster Sam Bankman-Fried gave tens of millions of customer dollars to crypto-friendly politicians, and now the customers want that money back. His crypto fund FTX is now bankrupt, and now he is under house arrest.

To judge crypto you can also look at the other crypto boosters and their agendas. For example, consider the so-called “effective altruist” (EA) movement, a small crowd effective mostly in persuading rich people to take big risks today in hopes of making money tomorrow, which might solve world problems later. Their reasoning is specious, and their track-record smarmy and self-promoting. The EA crowd has been promised billions by various crypto founders, so of course they want crypto to succeed. They’ll have nothing otherwise.

Economic Perpetual Motion

As two more question marks, look at the two businesses which first made crypto seem worthwhile (if not actually legitimate), money-mining and money-laundering.

The computational process called “mining” started with Bitcoin. Mining is successful when it solves a tough computational problem, in which case it generates one new Bitcoin. Money-mining uses loads of electricity—already half a percent of world production—making this “production” an environmental cataclysm all by itself. That energy use is paid for by the increasing rarity of new Bitcoin, algorithmically capped at a hard upper bound of about 20 billion coins. Most of those have already been mined. According to supply and demand, the 10% or so remaining coins will continue to rise in price, giving the appearance of increasing value of the underlying currency.

The other business model, money-laundering, doesn’t work any more. Crypto’s deeply disruptive role in tax evasion, illegal drugs and human trafficking was thanks to encrypting the identity of crypto owners. But as reported in WIRED, five years ago a multi-county sting operation took down the world’s two largest illegal drug-markets (AlphaBay and Hansa) simultaneously by breaking that secrecy code. While shutting those markets down, governments scooped up data on thousands of illegal buyers and sellers. The key to finding the culprits was a bag of statistical tricks for tracing supposedly untraceable, supposedly encrypted crypto identities, tricks so subtle and important even WIRED’s reporter was left to guess how they worked. That was five years ago, so the decrypting tools have probably been perfected. So much for anonymity.

In summary, crypto has an untrustworthy name, untrustworthy technology, untrustworthy business models, and untrustworthy people. Those all cast doubt crypto, and doubt is the enemy of trust.

However persuasive that line of argument may be, it has a tiny flaw. “Crypto is untrustworthy because people don’t trust it” sounds a lot like “I’m believable because people believe me,” yet another self-reinforcing narrative contagion. On its own, the phrase “crypto is untrustworthy” is only an evidence-based truism, but not as true as true could be.

On the other hand, the phrase “Crypto is untrustworthy, on principle” aspires to the highest echelon of truth, the truth of a Law of Nature. That’s where I come in.

The Bandwidth of Trust

To understand crypto you need to understand money, and to understand money you need to understand trust. We can explain how trust works by sorting out things we already understand or trust—concepts, biology, communication and material value—along two simple metrics, to see where crypto fits in among them.

So please permit me a boast: I am one of only two people in the world scientifically authorized to explain trust in the language of technology; the other is my wife Criscillia Benford. Together on a two-year sabbatical, six years ago, we co-authored the first and so far only mathematical paper (60 pages, 100 references) explaining trust. We explain trust as not a fixed certificate but as an ongoing interactive process. Specifically, the real-time process of model validation and updating, a process well-understood by technologists.

The key to trust is interactive bandwidth. The better and faster the connection between you and the thing you want to trust, the more trust you can have. Interaction is the feedback loop of examining, poking, and prodding by which people instinctively trust their eyes and other senses, but the idea works for people and machines alike. In some sense it’s been known forever, but only over the last few decades have technologists understood this interaction numerically.

Mathematician Claude Shannon invented the concepts of bits and bandwidth. Now, thanks to mathematical and technological innovations, we can quantify the “better and faster connection” on which trust depends as specific, quantified metrics like data format, continuity, latency, duration, noise, bandwidth, and so on. In fact, those six metrics are among the eight named by our paper’s title, “Sensory Metrics of Neuromechanical Trust.” Those metrics are used by a self-driving car looking at the road, and likewise by a human looking at the world. Those metrics explain trust in all its forms, anywhere in the universe. That’s the power of math.

Still, eight metrics is a lot of numbers to describe just one connection. Fortunately, we can simplify them down to just two for rough estimates. (Rough estimates are all you need, since differences tend to be huge. For example, two humans face-to-face in good light exchange a megabyte per second of visible microexpressions, while a “Like” on social media is but a single biased bit, a billion-fold less trustworthy).

The two numbers which best represent connection (and hence trust) are timing and complexity. Timing tells you about bandwidth and responsiveness. Complexity tells you how hard the thing is to decode. In general, the most trustworthy connections are fast and simple. The worst are slow and intricate.

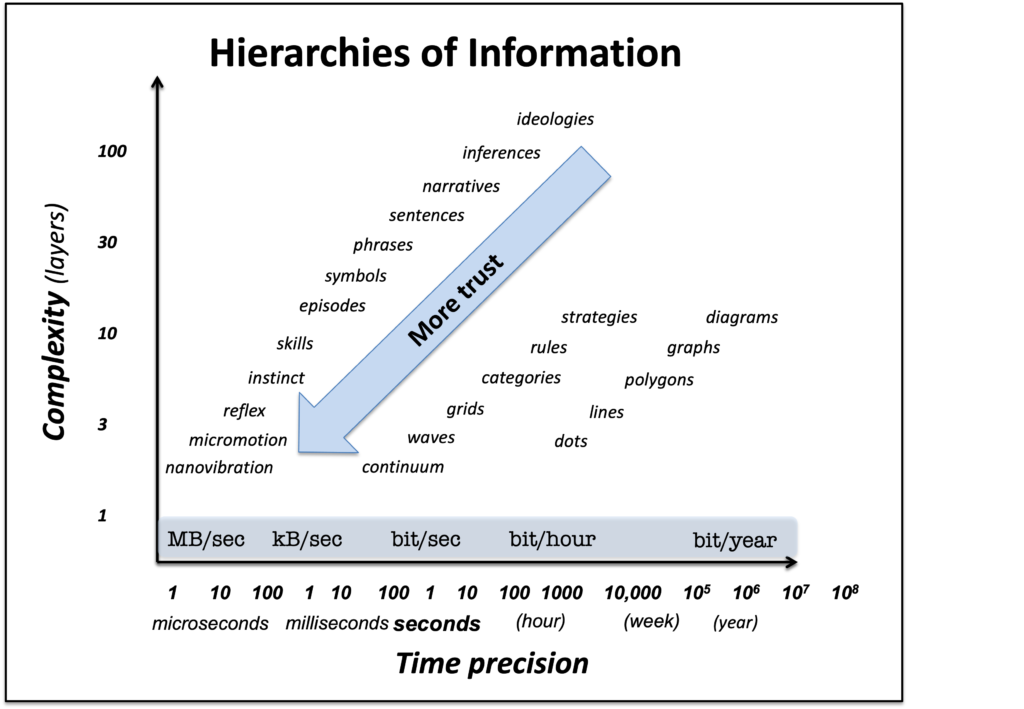

Now we can use these two metrics to rank some familiar examples. First by graphing some directly related informational concepts like symbols and categories, then by graphing a few examples from biology and technology. I’ll end by graphing sources of material value (including gold, shares, and crypto) so their trustworthiness is obvious in context.

Hierarchies of Information

Of the two metrics time and complexity, time is the simpler. For any information flow, the more precisely time can be determined, the more distinctions can be made in a given period, and thus the more information can be transmitted. This is the idea behind the concept of information flow per second, known as “bandwidth.” Bandwidth appears on the graph below as a bar showing roughly one megabyte per second (MB/sec) at a microsecond level of precision, slowing down to one bit per second at a one second level of precision. In fact that relation carries across the trillion-fold (million million) range from microseconds to years. Because trust is based on bandwidth, the farther to the left on the graph, the more trust, potentially billions-fold.

Complexity is more complex (of course!). Complexity is how information is shaped in space. The simplest things are like blank canvases or points, building into line segments (built of dots), polygons (built of lines), graphs, diagrams and so on. Likewise, a featureless medium is simplest, made slightly more complex by waves, even more so by grids (which have sharp edges), categories (which assign meaning to grid cells), rules (which assign meaning to categories), and so on. Because complex objects have more layers, unpacking or decoding them takes more time, and thus lowers the net bandwidth relative to something simpler using the same timing precision. So on the graph each “stack” of concepts rises diagonally to the right, as complexity gets bigger, timing gets coarser, and bandwidth gets smaller. Trust increases in the opposite direction, down and to the left.

Maslow’s Hierarchy of Human Needs

A first example of the relations between timing and complexity comes from life itself: what do people need to be alive, healthy, and fulfilled? Seventy years ago—about the time Shannon invented information theory—psychologist Abraham Maslow posited a “Hierarchy of Human Needs.” Starting with basics like food and safety, his pyramid of what makes life work ascended from food up through friendship, esteem, and self-actualization.

Those and other needs are easily sorted by timescale and complexity. At the fast end, humans die in minutes without oxygen, a very simple molecule. On the other hand, self-actualization may take decades, and is so complex it’s hard to even describe. Everything else people need—safety, warmth, gravity, digestive bacteria, exercise—lies somewhere in between those extremes of timescale and complexity. Here’s what that looks like on the graph:

Even though these needs are graphed the same way we graph trust, the lesson here isn’t about trust, but about how humans have both simple and complex needs, and about how much longer it takes to know if the complex ones are being met, or to suffer if they aren’t. Which, in a sense, may be about trust after all. A person can trust whether they’re breathing much faster than whether they think their life is successful.

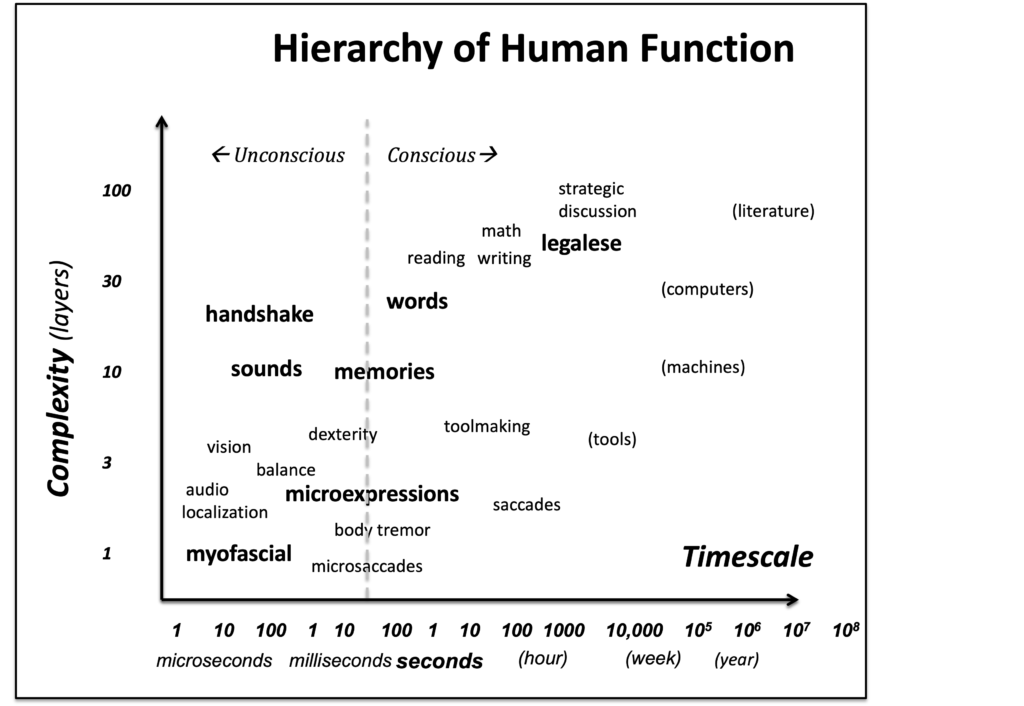

Hierarchy of Human Function

Insofar as trust is a human function, it ought to be related to other human functions. So let’s graph (almost) all those functions at once, ordered as before by timescale and complexity.

The fastest, simplest functions in a human body are the ultrasonic nano vibrations coursing through our bones and myofascial tissue (these are like a “carrier wave” for sensation and control, and have far too high an information density to sense consciously). These vibrations are the basis of “trusting your senses,” and indeed on the graph they reside in the high-trust zone of the lower left. Other human functions with high time precision also have high trust. For example, auditory localization, vision, hearing, and touch need microsecond resolution to work their best, but microsecond mechanisms are inaccessible to human awareness. That means (paradoxically) that our most important and trusted internal operations are effectively invisible.

On the other hand, the operations we humans are most proud of—reading, writing, math, strategy, enduring artifacts—can be sensed and kept track of, but by the same token they have low bandwidth and trust. It’s easier to doubt a document than to doubt your eyes.

Hierarchy of Communications Technology

For a million years, paleo people communicated only with their bodies, for example using grunts, songs, caresses, smiles, and so on. Those bodily communications channels make up the natural human data protocol, and thus are in the high-trust zone.

Historically, bandwidth and trust started going down when language and tools appeared. Those innovations inexorably moved attention away from the deep but unconscious diversity of messy natural signals, and toward standardized, repeatable chunks which are easy to recognize, and also easy to fake. As algorithmic operations chunking, repeatability, and recognition all move up the abstraction hierarchy and down the bandwidth spectrum. That is, they reduce trust.

To compress information, for example, one typically removes small redundant details. But the redundancy of those details helps validate that the message is real, just like micro-expressions on someone’s face indicate whether they are telling the truth. Removing such details reduces trust.

Over centuries our communications have become more and more compressed. For example, spoken words became writing on parchment, then typing on paper, then email, then SMS, then tweeting, each shorter, faster, and more compressed. The vanishing physical detail makes it hard to know if a message was even sent by a real person (half of Twitter posts are by bots). So such messages are that much harder to trust. Likewise over history, voices in air transitioned to copper-wire telephone calls, then voice-over-internet, then mobile, again each version more compressed and more shorn of the expressive nuance by which we trust speech.

Hierarchies of Material Value

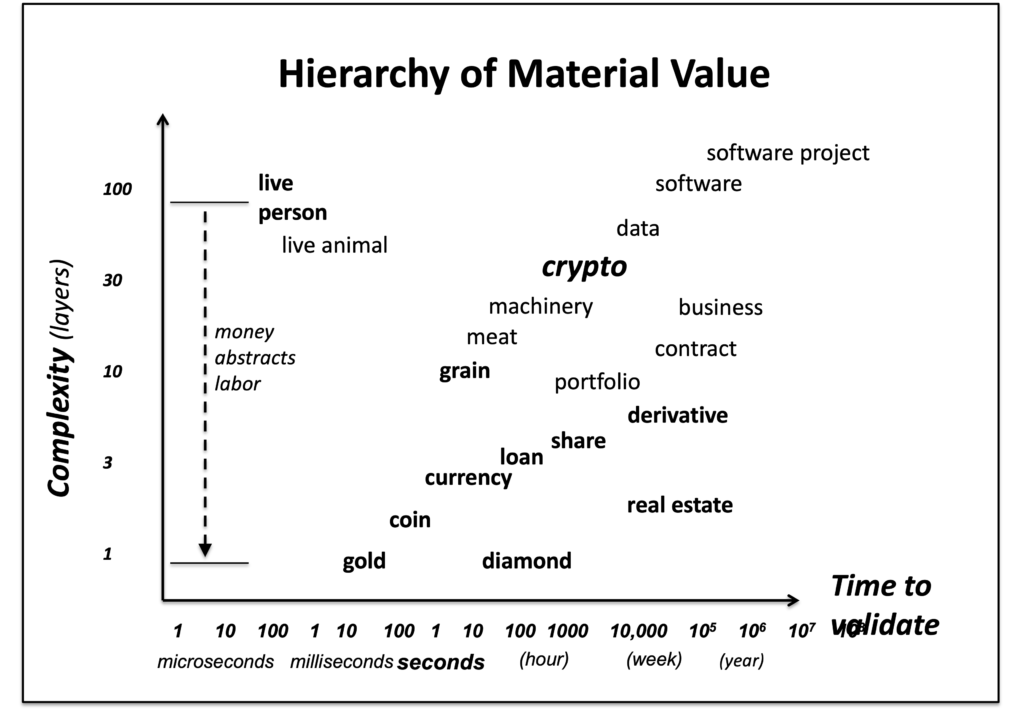

Now we can finally understand money (and crypto).

For a million years our ancestors were foragers, eating what they found and carrying nothing. When food and tools appeared so did exchange and barter, in which the source of value could be seen and poked close up—Nuts? Berries? Grain—to take advantage of trust in our senses. You could trust it because it was right in front of you.

The invention of “money” as an exchange commodity suddenly made impromptu validation even faster. Gold, for example, has a sheen, weight, and hardness that is easy to validate and very hard to fake. And solid gold is as simple as can be. You can feel the weight, see the sheen with your eyes, and maybe even bite into a coin to check whether it is soft (made of lead, hence a fake) or hard, which proves it’s real.

Compared to gold, diamonds are slower to check (one needs an expert), and paper currency is more fakeable, even if decorated with holographs and color-changing ink. More abstract forms of value like shares, derivatives, and portfolios are yet more artificial, and thus dependent for their value on rules and technologies of validation. We can’t inspect shares with our fingers and teeth, and we can’t understand the complex rules by which banks decide who owns what, or even be sure those rules are applied fairly. All those intervening steps make trust go down.

So when one graphs material value by these metrics of trust, crypto ranks not only worse than gold, but worse than stock portfolios and business contracts. The same principles by which paper money is less trustworthy than gold also say that crypto is less trustworthy than paper, or even than owning shares.

The admired American investor Warren Buffett made these points when talking about Bitcoin: “It’s not a currency. It does not meet the test of a currency….. It is not a durable means of exchange, it’s not a store of value.”

In summary, the mathematical principles of trust-formation were hard-wired into the human nervous system millions of years ago exactly to deal with live humans and Mother Nature. Those principles work best on real things in real time, and work worst on artificial things after the fact. Crypto is the least-real, most artificial invention ever considered to be money, so according to those principles it can’t be trusted. In short: Crypto is untrustworthy, on principle.

The views expressed in this article are the author’s own and do not necessarily reflect Fair Observer’s editorial policy.

Support Fair Observer

We rely on your support for our independence, diversity and quality.

For more than 10 years, Fair Observer has been free, fair and independent. No billionaire owns us, no advertisers control us. We are a reader-supported nonprofit. Unlike many other publications, we keep our content free for readers regardless of where they live or whether they can afford to pay. We have no paywalls and no ads.

In the post-truth era of fake news, echo chambers and filter bubbles, we publish a plurality of perspectives from around the world. Anyone can publish with us, but everyone goes through a rigorous editorial process. So, you get fact-checked, well-reasoned content instead of noise.

We publish 2,500+ voices from 90+ countries. We also conduct education and training programs

on subjects ranging from digital media and journalism to writing and critical thinking. This

doesn’t come cheap. Servers, editors, trainers and web developers cost

money.

Please consider supporting us on a regular basis as a recurring donor or a

sustaining member.

Will you support FO’s journalism?

We rely on your support for our independence, diversity and quality.

Comment