Over the past two and a half years, the news cycle has been dominated by unanticipated conflict, first in Ukraine then in Gaza. But this had already become an era of unexpected events, including a lifestyle-changing pandemic. Since 2008, financial markets have repeatedly undergone unprecedented transformational shifts in methods and perspectives. The geopolitical uncertainty associated with wars in which the United States is heavily implicated, has added yet another layer to the complexity to the global economic landscape.

Was it Mark Twain, physicist Niels Bohr or baseball player Yogi Berra who first observed, “It’s difficult to make predictions, especially about the future”? Never has this been more true, especially if the task consists of predicting the evolution of the role of the US dollar, the centerpiece of what some still refer to as “the rules-based international order.”

The first two rules for actors in any economy derive from the responses to a pair of questions: “How much does it cost?” and “How can I pay?” For a quarter of a century, the standard answer to the second question was: “with dollars, because of gold.” Then began more than five decades when the answer might have been: “with dollars, because of oil.” George Bush’s global war on terror and the shale revolution in North America began to shake things up. The tide known as dedollarization has been rising ever so slightly in recent years, which means the answer may have to change again and the answer may become more varied. Gold? Crypto? CBDCs (Central Bank Digital Currencies)? A BRICS commodity-based currency? The yuan? Local currencies through bilateral exchange? And even barter? The field appears wide open.

This week, I impertinently asked ChatGPT-4o to weigh in on the question, not because I believe the chatbot knows anything that we don’t know, but because what it does well is synthesize what other people have been chattering about. Here is what it told me:

The movement away from the dollar as the dominant international currency is likely to accelerate in 2024, driven by geopolitical, technological, and economic factors. This shift could lead to a more multipolar currency system, increasing the complexity and dynamism of international financial markets and payment systems. In the short term, this transition might result in greater volatility and adjustments as markets and nations adapt to the evolving landscape.

Just this past week, India and Russia settled a $4 billion trade in rupees. We may see that as an indirect effect of US sanctions related to the war in Ukraine and the weaponization of the dollar. But it is also an indicator of a developing trend. ChatGPT is right to warn us.

Opening up the discussion

Several months earlier, in response to another item in the news — that the UAE had used the digital dirham for the very first time — I opened up the question to members of our circle who, unlike myself, were truly knowledgeable about international financial markets and geopolitical trends. The first to respond was our editor-at-large Alexander Gloy, who has penned compelling articles on all matters monetary for Fair Observer. Alex was followed in short order by a friend of the team, a seasoned entrepreneur whose work in many countries across the globe has endowed him with an outstanding understanding of international finance, who prefers to go by the name of Edward Quince.

The team agreed to the idea of launching this rubric by publishing these private reflections from earlier in the year. We will then open up an unfolding dialogue to all interested readers who have their own wisdom to contribute or serious questions to ask. We see this as a kind of collective research project. The aim is less to predict the future than — let’s coin a word — to “pre-understand” a rapidly changing landscape.

So it was that, in early February, Alex responded to my questions about how significant the UAE’s clearly dedollarizing decision may have been. Others then joined the conversation. Their contributions will appear in the following installments.

Here then is the very opening round of shared insight.

From Alex Gloy, Feb 4, 2024

Dear Atul, Peter, Edward,

I recently found a book at my parents’ house. It’s title: “The End of the Dollar”. It was from 1975.

This is just to show that the dollar has somehow “resisted” its apparent fate for a long time.

A couple quick of thoughts:

- Since the US is a perennial deficit country, more goods and services go in than out. That means more dollars are going out than in. That means those dollars must accumulate abroad. As long as export nations accept US dollars for their goods and services, this will continue. If they stopped accepting US dollars they would lose an important, if not their biggest, customer.

- Nations lacking enough domestic energy must import fossil fuels. As long as those are priced in USD, the importing country must first acquire US dollars to be able to pay the invoice. With global crude oil consumption at 100 mbpd (million barrels per day), and 80 mbpd ex US, an oil price of $75 per barrel and 365 days in a year this generates dollar demand of $2.33 trillion per year. These are the so-called petro-dollars. The “trick” then is to convince oil producers (those selling in USD) not to convert their receipts into domestic or other currencies. The Saudi Riyal is too small of a currency to be able to absorb the vast amounts of US dollars coming into the country – the exchange rate would “explode”. At one point the Saudis were dismayed at the falling purchasing power of the US dollar, apparently threatening to purchase gold. Wikileaks published some cable that indicates the US being worried about such a move. In my opinion, although I have no proof, the Saudis were convinced not to purchase gold in large amounts. Instead, they were given assurances the gold-to-oil ratio would remain within certain boundaries (so that it would not matter how the US dollar evolved). As the price of gold increases, this requires the price of oil to increase, too. It is therefore not a surprise to see the US intervening in or sanctioning countries with large oil and gas reserves like Venezuela, Russia and Iran, and occasionally providing military assets to both conflict parties (Iran-Iraq) that potentially could become large exporters of fossil fuels. Gold price suppression can be achieved by diverting physical demand towards exchange-traded funds (ETF) that have questionable claims on unallocated gold pools. Every gold ETF purchased is one ounce of physical gold less purchased. While the trading center for physical gold is London, the price is being dominated by futures trading in Chicago. The vast majority of futures positions are being closed before expiration, and only a tiny fraction comes to delivery.

- In currency trading, by definition, at least one of the currencies is “offshore”. The exact size of the offshore dollar market is unknown, but estimated to be around $60 trillion. Those so-called Eurodollars have been created outside the US by non-US private sector firms and have no central bank (that’s why the Federal Reserve offers dollar swap lines to friendly non-US central banks in case of a dollar shortage). The Eurodollar market has developed without supervision, out of convenience. It is an extremely liquid market which borrowers and lenders prefer due to its depth. It will be very hard to replace this market. Currencies like the Dirham are, sorry for being blunt here, a joke compared to the Eurodollar market. The Central Bank of UAE has a balance sheet of 552bn AED or $150bn – less than the market value of Facebook/Meta increased in the first 30 minutes on Friday!

- Cross-border CBDC transactions are nice, but very limited in size. Cross-border cross-currency CBDC transactions would be better. But why DLT (Distributed Ledger System or blockchain)? There is no reason for DLT – the central bank runs the “ledger” for bank reserves, and surely would want to run the ledger for CBDC. Why would you decentralize a “central” bank digital currency?

- Leaders of oil exporting nations that floated ideas of a gold-backed currency (Libya) or selling oil against Euros (Iraq) found their life spans cut artificially short (Gaddafi, Hussein).

- Yes, anti-CBDC sentiment in certain US states and among right-leaning populations is an issue. But it doesn’t affect the international role of the USD.

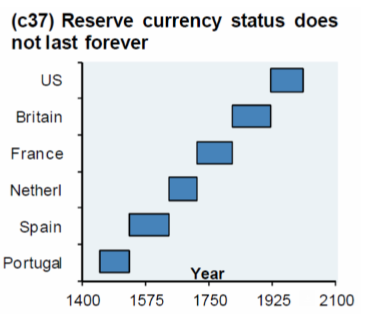

It is very hard to dethrone the USD, and it will take a long time. It will eventually happen, since the issuer of the world’s reserve currency is “forced” into running perennial deficits (how would the currency find its way abroad otherwise), which leads to an increasing indebtedness towards foreign investors over time.

Best,

Alex

An accelerating trend

Since Alex’s prudent reminder of historical reality in February, stories about an increasing trend toward dedollarization are cropping up in the news every day. Readers of the news have to wonder whether the reign of the dollar is truly weakening. And if so what will its implications be in the coming months and years?

Alex seems to be suggesting that the idea of a struggle to dethrone the almighty greenback may be little more than the kind of evergreen story journalists can come back to when they have nothing else to write about.

Here at Fair Observer, we want to hear and publish all the serious takes. We believe that in 2024, a year shaken by the major drama of wars and elections that tend to dominate the headlines, the unfolding plot around the status of the dollar is interesting for two compelling reasons. The first is that the dollar’s fate, as the entity that defines monetary value for the human race, is closely connected with other geopolitical trends that are clearly and in some ways radically changing our perception of how power is distributed and exercised in the world. The second is that the story frankly contains a strong dose of entertaining suspense.

Join the debate

This weekly rubric, Money Matters…, is dedicated to developing this discussion. We invite all of you who have something to contribute to send us your reflections at dialogue@fairobserver.com. We will integrate your insights into the ongoing debate.

*[Fair Observer’s “Crucible of Collaboration” is meant to be a space in which multiple voices can be heard, comparing and contrasting their opinions and insights in the interest of deepening and broadening our understanding of complex topics.]

The views expressed in this article are the author’s own and do not necessarily reflect Fair Observer’s editorial policy.

Support Fair Observer

We rely on your support for our independence, diversity and quality.

For more than 10 years, Fair Observer has been free, fair and independent. No billionaire owns us, no advertisers control us. We are a reader-supported nonprofit. Unlike many other publications, we keep our content free for readers regardless of where they live or whether they can afford to pay. We have no paywalls and no ads.

In the post-truth era of fake news, echo chambers and filter bubbles, we publish a plurality of perspectives from around the world. Anyone can publish with us, but everyone goes through a rigorous editorial process. So, you get fact-checked, well-reasoned content instead of noise.

We publish 2,500+ voices from 90+ countries. We also conduct education and training programs

on subjects ranging from digital media and journalism to writing and critical thinking. This

doesn’t come cheap. Servers, editors, trainers and web developers cost

money.

Please consider supporting us on a regular basis as a recurring donor or a

sustaining member.

Will you support FO’s journalism?

We rely on your support for our independence, diversity and quality.

Comment