Donald Marron, Director of the Tax Policy Center who served as a member of the President's Council of Economic Advisors between 2002-2009, discusses President Obama's deficit reduction proposal.

President Obama’s budget identifies a group of policies as a $1.8 trillion deficit reduction proposal. I found the budget presentation of this proposal somewhat confusing; in particular, it is difficult to see how much deficit reduction the president wants to do through spending cuts versus revenue increases.

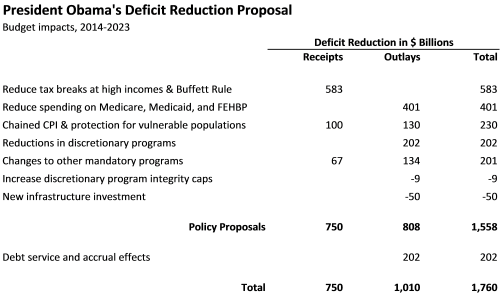

After some digging into the weeds, I pulled together the following summary to answer that question:

The proposal would increase revenue by $750 billion over the next decade. Much media coverage has been incorrectly suggesting an increase of either $580 billion (revenue from limiting tax breaks for high-income taxpayers and implementing a “Buffett Rule”) or $680 billion (adding in the revenue that would come from using chained CPI to index parameters in the tax code).

But there’s another $67 billion in additional revenue. Almost $47 billion would come from greater funding for IRS enforcement efforts that lead to higher collections. To get that funding, Congress must raise something known as a “program integrity cap.” The administration thus lists this as a spending policy, but the budget impact shows up as higher revenues (assuming it works—such spend-money-to-make-money proposals don’t always go as well as claimed, although there is evidence that IRS ones can). Several similar administrative changes in Social Security and unemployment insurance add almost $1 billion more.

Another $20 billion would come from increasing federal employee contributions to pension plans. That sounds like a compensation cut to me and, I bet, to affected workers, and would be implemented through spending legislation. Under official budget accounting rules, however, it shows up as extra revenue as well.

In total, then, “spending” policies would generate more than $67 billion in new revenue.

Taken as a whole, the president’s deficit reduction proposal includes $750 billion in revenue increases, $808 billion in programmatic spending cuts, and $202 billion in associated debt service savings. The proposal thus involves about $1.1 in programmatic spending cuts for every $1 of additional revenue.

At least according to traditional budget accounting. If you believe (as I do) that many tax breaks are effectively spending in disguise, the ratio of spending cuts to tax increases looks much higher. From that perspective, much of the $529 billion that the president would raise by limiting deductions, exemptions, and exclusions for high-income taxpayers should really be viewed as a broadly-defined spending cut. I haven’t had a chance to estimate how much of that really is cutting hidden spending, but even if only three-quarters is, the ratio of broadly-defined spending cuts to tax increases would be 3.5-to-1.

*[This article was originally published by Donald Marron on April 23, 2013]

The views expressed in this article are the author's own and do not necessarily reflect Fair Observer’s editorial policy.

Support Fair Observer

We rely on your support for our independence, diversity and quality.

For more than 10 years, Fair Observer has been free, fair and independent. No billionaire owns us, no advertisers control us. We are a reader-supported nonprofit. Unlike many other publications, we keep our content free for readers regardless of where they live or whether they can afford to pay. We have no paywalls and no ads.

In the post-truth era of fake news, echo chambers and filter bubbles, we publish a plurality of perspectives from around the world. Anyone can publish with us, but everyone goes through a rigorous editorial process. So, you get fact-checked, well-reasoned content instead of noise.

We publish 2,500+ voices from 90+ countries. We also conduct education and training programs

on subjects ranging from digital media and journalism to writing and critical thinking. This

doesn’t come cheap. Servers, editors, trainers and web developers cost

money.

Please consider supporting us on a regular basis as a recurring donor or a

sustaining member.

Will you support FO’s journalism?

We rely on your support for our independence, diversity and quality.

Comment