Big pharma competes bitterly with the tech giants for the title of the most dodgy corporate sector in the world. Given this battle, it is astonishing that, on May 27, 2025, nearly one-quarter of shareholders at Merck & Co. (MRK, known outside of North America as Merck Sharp & Dohme or MSD), one of the largest in the big pharma sector, voted in favor of greater tax transparency. While this will not immediately change corporate practices, it demonstrates that a significant portion of global investors continue to support greater tax transparency. Corporate executives would be foolish not to take note.

This shareholder resolution, the only one of its kind this year, requested that Merck comply with the Global Reporting Initiative Tax Standard, which includes the most widely accepted format for public country-by-country reporting. This resolution follows others at Microsoft, Amazon, Cisco and Brookfield in previous years, which received similar levels of shareholder support. The significant level of support on a new issue is impressive since prior to these recent efforts, tax transparency had been rarely raised by investors at North American corporations. The prevailing narrative has been that the less tax a corporation pays, the more profits for investors, but it is now shifting.

Increasingly, investors are aware that aggressive tax avoidance has its risks. Likewise, long-term investors want corporations to compete based on quality, innovation and smart business strategies rather than a willingness and ability to exploit short-term loopholes. Corporations can’t continue to claim social responsibility and then avoid tax obligations where sales are made. Microsoft, now facing a nearly $30 billion IRS audit — perhaps the biggest corporate tax bill in world history — is a clear case. While Microsoft claims to support the UN’s Sustainable Development Goals, it continues to shift global profits away from where products are sold to places like Ireland. In the short term, Ireland is raking in revenue, but this is at the expense of countries around the world missing out on funding for health, education, sanitation and basic infrastructure.

Big pharma’s global tax dodging has been the focus of excellent analyses by Oxfam over many years. More recently, big pharma’s profit shifting has also been the focus of US Senate investigations and even garnered attention from President Trump, who proposed tackling the issue with a fresh round of tariffs on Ireland. However, big pharma’s tax dodging is even more problematic than in other sectors since it benefits hugely from public spending, tax incentives and subsidies.

Tax transparency should be required across the board from all multinationals, as Merck and others have argued to avoid taking a lead. The good news is that Merck and many other multinationals will now be required to report on a partial country-by-country basis in Australia. Theoretically, Merck will be required to comply with the EU directive on public country-by-country reporting as well, and told shareholders it would do so. However, Romania was the first EU country to implement the directive, and Merck chose to only report on Romania and not any other EU jurisdiction.

US big pharma pays nothing in US tax

Merck has something to hide and dodges more taxes in the US than any other country. A recent analysis of tax payments of the six largest US big pharma corporations revealed a collective US tax bill of less than zero in 2024, following the same pattern in the prior year. That analysis concludes that “it’s the predictable result of the tax and production structures that most large U.S. pharmaceutical companies have adopted following the 2017 Tax Cut and Jobs Act (TCJA).” Trump’s first round of tax cuts is now being extended in the “One Big Beautiful Bill,” which is shaping up as a protection racket for US multinationals to continue to avoid US taxes and threatening countries collecting tax on profits earned by US corporations from sales in their own jurisdiction.

Of these six US big pharma corporations, Merck may be the dodgiest. Despite reporting more than half of its revenue in the US, it reported a loss of almost two billion dollars in the US while making $22 billion abroad in 2024. Without public country-by-country reporting, it is difficult to know where Merck does business and pays tax (or not) outside of the US. Amgen, another of the six US big pharma corporations, is already being pursued by the IRS for a $10.7 billion tax bill after shifting profits to Puerto Rico, and it faces a class action shareholder lawsuit for failure to disclose its liabilities in a timely manner.

Under the Trump administration, tax dodging in the US by the largest US multinationals will likely get even worse, but there is progress elsewhere.

Looking up from down under

Even before the implementation of Australia’s public country-by-country reporting requirement, it is possible to get a glimpse of Merck’s global tax practices, looking from down under and up. The view will be even clearer in 2026, when Merck — and many other multinationals with at least 10 million Australian dollars ($6,531,900) in revenue in Australia — will be required, for the first time, to publicly report on the basic financial details of its subsidiaries in Switzerland, Bermuda, Singapore, Panama, Cyprus, Hong Kong and the Cayman Islands.

Merck Sharp & Dohme (Holdings) Pty Ltd. is Merck’s primary subsidiary in Australia. Data published by the Australian Taxation Office (ATO) and compiled here shows that Merck had nearly 1.4 billion Australian dollars ($914,256,000) in revenue in the 2023 financial year and paid only 20.8 million Australian dollars ($13,578,240) in tax. This represents an estimated profit margin in Australia of 11.3% and an effective tax rate of 13.4%, less than half of Australia’s 30% corporate tax rate. Over a decade (2014-2023) the estimated profit margin averaged 9.13% with an average effective tax rate of only 12.9%. If actual profit margins in Australia were closer to Merck’s global margins (currently above 27% and averaging nearly 20% over the last 5 years), and the rate of tax paid was closer to the statutory rate, this would represent hundreds of millions in additional tax payments owed in Australia. Possible lost tax revenue in other countries, with less transparency and less enforcement, may be far greater.

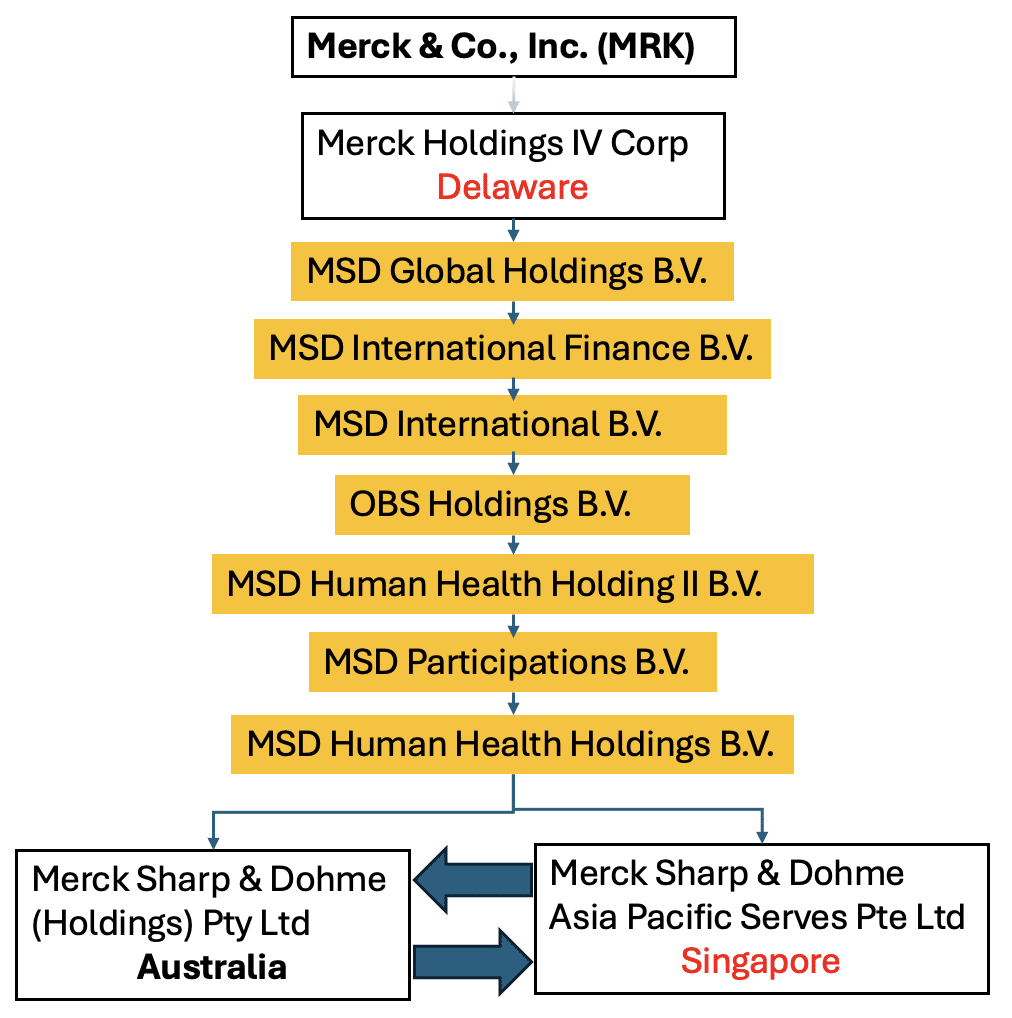

A review of the most recent (2023) financial statement of Merck Sharp & Dohme (Holdings) Pty Ltd reveals how it may be artificially reducing taxable income and significantly lowering its tax payable in Australia. Firstly, the Australian company’s immediate parent is MSD Human Health Holdings B.V. in the Netherlands. This Dutch entity was paid 18.7 million Australian dollars ($12,209,230) in dividends in 2023 and 20 million Australian dollars ($13.058,800) in 2022. The Australian entity reported sales revenue of 717 million Australian dollars ($468,158,069) in 2023, but this included related party purchases (“made on normal commercial terms”) of 625 million Australian dollars ($408,068,660) with an outstanding balance payable of 137 million Australian dollars ($89,448,670). These purchases were made with several Merck subsidiaries in tax havens. However, the largest direct source of finished goods sold in Australia is most likely Singapore subsidiary Merck Sharp & Dohme Asia Pacific Services Pte Ltd. This appears to be a tell-tale sign of classic multinational tax dodging with Singapore playing a central role in profit-shifting in the Asia-Pacific region.

Interestingly, the Singapore subsidiary has the same immediate parent as the top-level Australian subsidiary and then follows a string of ownership through the Netherlands and on to Delaware. The structure, as displayed in the chart below with the seven Dutch companies in orange, does not seem to represent any rational business purpose. There is considerably more transparency in Australia, Singapore and the Netherlands so we can see this structure, but it is likely that its operations in the US and around the world are structured in a similar manner to minimise tax paid everywhere.

Simplified structure of Merck’s Australian business

Not murky for long…

Merck can hide its murky profit shifting and tax dodging for a bit longer, but greater tax transparency is coming soon. Some global companies, over 150, are leading the way now. Others will linger in the dark as long as possible before being forced out into the sunlight. The scale of multinational tax dodging is already clear, but soon the public will know who, where and how. At that point, further demands for specific changes in corporate behavior and calls for reforms to level the playing field and fund the public services and the just transition we all need will be unstoppable!

[Tax Justice Network originally published this piece]

[Kaitlyn Diana edited this piece]

The views expressed in this article are the author’s own and do not necessarily reflect Fair Observer’s editorial policy.

Support Fair Observer

We rely on your support for our independence, diversity and quality.

For more than 10 years, Fair Observer has been free, fair and independent. No billionaire owns us, no advertisers control us. We are a reader-supported nonprofit. Unlike many other publications, we keep our content free for readers regardless of where they live or whether they can afford to pay. We have no paywalls and no ads.

In the post-truth era of fake news, echo chambers and filter bubbles, we publish a plurality of perspectives from around the world. Anyone can publish with us, but everyone goes through a rigorous editorial process. So, you get fact-checked, well-reasoned content instead of noise.

We publish 3,000+ voices from 90+ countries. We also conduct education and training programs

on subjects ranging from digital media and journalism to writing and critical thinking. This

doesn’t come cheap. Servers, editors, trainers and web developers cost

money.

Please consider supporting us on a regular basis as a recurring donor or a

sustaining member.

Will you support FO’s journalism?

We rely on your support for our independence, diversity and quality.

Comment