China has significantly expanded its currency swap agreements in recent years, using them as a strategic instrument of financial diplomacy to enhance the global standing of the renminbi (RMB). While these agreements offer short-term liquidity to partner nations, they also serve broader geopolitical objectives, particularly by challenging the US dollar’s dominance in international finance. However, this strategy raises concerns, including the risks of economic dependency, the potential for political leverage and broader implications for global financial stability.

China’s swap lines: structure and expansion

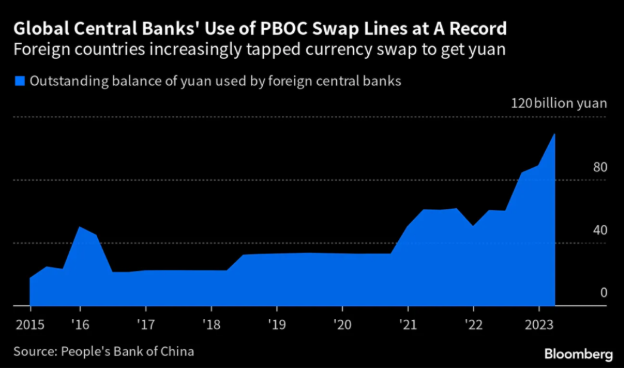

The People’s Bank of China (PBOC) has established bilateral currency swap agreements with over 40 countries, which amount to an estimated $500 billion in total commitments. These agreements provide foreign central banks with access to RMB liquidity in exchange for their local currency, ostensibly to facilitate trade and enhance financial stability. Unlike the US Federal Reserve’s (or the Fed’s) swap lines, which primarily support allied economies and major financial centers, China’s swaps are frequently extended to emerging markets facing liquidity crises, such as Argentina, Pakistan and Sri Lanka.

A key distinction between China’s swap agreements and Western financial mechanisms lies in their structure and conditions. China strategically deploys these arrangements to countries with strong economic ties or significant reliance on Chinese investments, particularly under the Belt and Road Initiative. However, due to the RMB’s limited convertibility, recipient nations often find that the funds must primarily be used for trade with China rather than broader financial needs. Additionally, there is growing evidence that these agreements serve as instruments of geopolitical influence, with financial support often conditioned on diplomatic alignment with Beijing’s interests.

Geopolitical implications: challenging the dollar-dominated system

For decades, the US dollar has been the world’s primary reserve currency, with the Fed’s swap lines acting as a financial lifeline for major economies. China’s expansion of RMB swap agreements presents an alternative liquidity source, particularly for nations facing restricted access to dollar-based financial systems due to sanctions or economic instability. Argentina’s use of a $1.7 billion RMB swap in 2023 to meet its IMF debt obligations marked a significant precedent, as it demonstrated how an emerging economy could bypass dollar reserves in favor of RMB transactions. Similarly, Russia’s increasing reliance on RMB for trade settlements following Western sanctions in response to the war in Ukraine illustrates how China’s financial instruments can provide an alternative to US-led economic pressures.

China’s financial leverage and Pakistan’s sovereign risks

China’s currency swap agreements provide emergency liquidity for struggling economies but often create financial dependencies that heighten economic vulnerabilities. Pakistan has repeatedly relied on Chinese swap lines to manage its balance-of-payments crisis, which has effectively tied its financial stability to Beijing. Similarly, Sri Lanka, after depleting its swap reserves, became increasingly dependent on Chinese financial goodwill. This has complicated its debt restructuring efforts with Western creditors.

Unlike the IMF, which mandates structural reforms for financial aid, China’s swap agreements lack transparency, raising concerns about opaque debt arrangements and potential political leverage. This opacity increases the risk of long-term financial instability for recipient nations, allowing China to exert greater influence over their economic and political decisions.

Pakistan’s growing economic reliance on China is most evident in the $65 billion China–Pakistan Economic Corridor (CPEC), which has significantly eroded Pakistan’s strategic autonomy. With $26.6 billion in outstanding debt to China, Pakistan remains trapped in a cycle of borrowing, even as it struggles with IMF bailouts. Despite concerns over unsustainable debt, Islamabad continues to pursue new CPEC projects, deepening its financial entanglement.

Security threats to CPEC projects have further complicated this relationship. The Balochistan Liberation Army, a militant group operating in Pakistan, has targeted CPEC-related infrastructure — its attacks have killed over 60 Chinese workers since 2016. In response, Beijing has expanded its security role in Pakistan. China has pressured Islamabad to enforce its Global Security Initiative, which includes counterterrorism efforts, enhanced border security and joint security exercises in Gilgit-Baltistan and Xinjiang. These developments underscore the shifting nature of China–Pakistan relations, where economic cooperation increasingly overlaps with security and strategic interests.

China’s leverage in Argentina and the future of the swap line

China’s financial relationship with Argentina has been largely asymmetrical, with Beijing holding substantial control over when and how the swap line is utilized. While China has historically used this mechanism to strengthen its influence in Argentina, Argentinian President Javier Milei’s strong anti-China rhetoric complicates future cooperation. If Milei aligns more closely with Washington, China may reconsider its financial support and potentially cut off access to the swap line. Some Chinese analysts suggest that Beijing should take a firmer stance, demanding a shift in Argentina’s political rhetoric before continuing financial support. Although an immediate termination of the swap agreement is unlikely, China could leverage its financial influence to pressure Argentina into maintaining pragmatic ties.

Since 2008, the PBOC has signed many currency swap agreements with foreign central banks, making China a key global lender. These agreements serve both economic and political purposes, increasing China’s influence worldwide. This study looks at how these swaps affect public opinion in Argentina, which has used the swaps to manage economic crises. During the 2023 election period, a survey was conducted to see if informing people about China’s financial aid would change their views. The results show that while some voters became more supportive of China, others, particularly opposition supporters, became more critical. They suggested that China’s financial diplomacy has a mixed and polarized effect on public opinion.

A double-edged sword?

China’s currency swap strategy represents a bold attempt to reshape global financial dynamics, offering an alternative to the US dollar while extending Beijing’s geopolitical reach. However, structural limitations — such as the RMB’s lack of full convertibility, concerns over transparency and fears of economic dependency — present significant challenges to its broader adoption. While China’s swap lines provide immediate relief to financially distressed economies, they may also introduce long-term vulnerabilities, which would reinforce reliance on Beijing rather than foster sustainable economic independence.

If China seeks to establish the RMB as a true global alternative to the dollar, it must address these critical deficiencies. Greater transparency in swap agreements, increased RMB liquidity in global markets and improved trust in Chinese financial institutions will be essential in achieving this goal. Otherwise, China’s currency swap strategy may be viewed less as a stabilizing force and more as a mechanism for exerting financial dominance with political strings attached.

[Lee Thompson-Kolar edited this piece.]

The views expressed in this article are the author’s own and do not necessarily reflect Fair Observer’s editorial policy.

Support Fair Observer

We rely on your support for our independence, diversity and quality.

For more than 10 years, Fair Observer has been free, fair and independent. No billionaire owns us, no advertisers control us. We are a reader-supported nonprofit. Unlike many other publications, we keep our content free for readers regardless of where they live or whether they can afford to pay. We have no paywalls and no ads.

In the post-truth era of fake news, echo chambers and filter bubbles, we publish a plurality of perspectives from around the world. Anyone can publish with us, but everyone goes through a rigorous editorial process. So, you get fact-checked, well-reasoned content instead of noise.

We publish 2,500+ voices from 90+ countries. We also conduct education and training programs

on subjects ranging from digital media and journalism to writing and critical thinking. This

doesn’t come cheap. Servers, editors, trainers and web developers cost

money.

Please consider supporting us on a regular basis as a recurring donor or a

sustaining member.

Will you support FO’s journalism?

We rely on your support for our independence, diversity and quality.

Comment

This is a detailed and interesting piece. However, it forgets a key point. Western institutions have been declining. That is why other countries are casting about for alternatives. Also, the West uses its financial architecture to impose its norms as well. China is playing the same game although not so well because it is fundamentally authoritarian and culturally insular. Yet money does buy China some love 😉