Still dealing with the aftermath of the COVID-19 crisis, the US economy is suffering from inflation and other economic headwinds. Buoyed by recent statements from Treasury Secretary Janet Yellen, however many in the financial and policy space are optimistic that the US economy is heading for a “soft landing.” They expect the turbulence to amount to a contained, brief economic retraction, rather than a full-blown recession. While these optimists think the economic facts speak for themselves, I’d like to present three points of consideration that indicate a less rosy forecast for the US economy.

Inflation increases despite previous declines

January prices indicate a 0.3% uptick in inflation, a potential sign that steady inflation declines are ending. The annual inflation report nearly mirrored January’s report, with most inflation declines being energy-related (fuel, natural gas, etc.), and the largest increases being vehicle insurance, housing, and medical costs. This data suggests that Americans’ buying power continues to be eroded by the cost of bare necessities. Without long-term price stability for shelter, food and medical expenses (especially hospital and emergency services), easing of inflation is at the whim of energy prices, which have started to creep up in January (most notably utilities, up 1.4%).

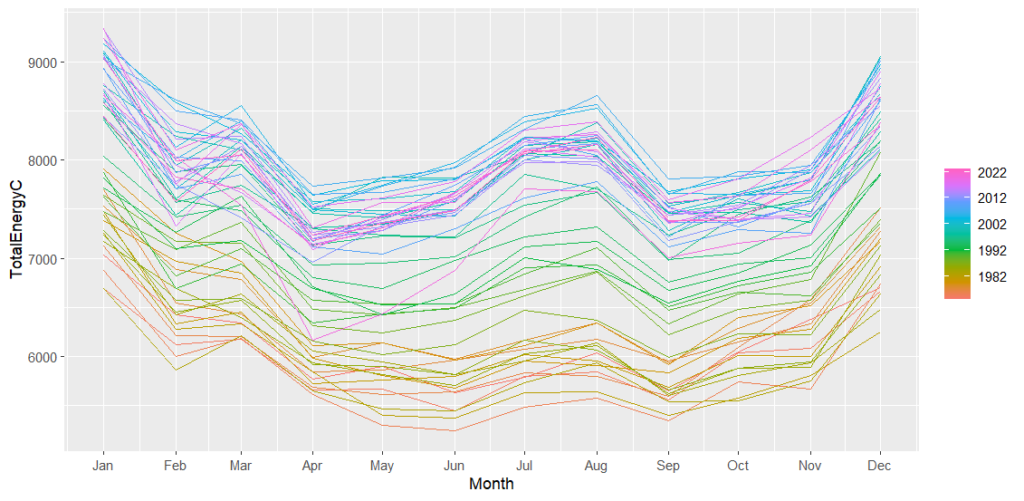

The good news for optimists is that December–January is typically the peak for energy consumption, which sharply declines as North America enters warmer weather beginning in February. This may assist in easing temporarily as demand slows. Unfortunately, the effect is short-lived, as consumption increases again in May and reaches a second peak in the hotter months of summer. If energy remains the largest factor behind decreases in inflation, the US may not reach its target of an enviable 2% inflation anytime soon.

In any case, energy prices are affected by more than consumption alone. Energy is a highly volatile market, and its prices are sensitive to political developments globally. Global supply chains are already fragile. The recent instability in the Middle East, particularly the Houthi attacks on shipping and the subsequent US responses in Yemen, will mean price increases on imported oil.

Accelerated tensions between Taiwan and China indicate trouble for other sectors of the economy as well. Taiwan makes up more than 60% of the global computer chip market. Many technology, automotive and medical device companies therefore rely on Taiwan’s chip manufacturing industry. A disruption in the supply of chips would create economic chaos for many of the highest-performing US stocks, because most of these stocks are in the tech sector. This would be particularly painful for investors, as technology companies such as Apple, Nvidia, and Microsoft made a staggering 70% of the S&P 500 returns in 2023.

Wage gains are deceiving at first glance

Another of the few key metrics that has led to optimism about a soft landing is labor. However, a few indicators point to this metric reversing. Bonuses for 2023 declined across all industries, suggesting that fiscal tightening is occurring across all economic sectors. This could signal the end of the wage hikes and bonus incentives that we’ve observed over the past few years.

While layoffs have been unevenly distributed across industries, the tech sector has continued laying off workers throughout 2023 and into the new year. With tech accounting for the bulk of aforementioned stock market returns, continued layoffs signal trouble for the broader US labor force. If the companies that returned record profits are laying off workers en masse, it’s only a matter of time before companies with lower earnings follow suit.

Optimists like to point to wage gains as a sure sign of economic recovery. However, observing these numbers at face value is misleading. While nominal wages have increased substantially in the past few years, inflation has increased even faster. When wage gains peaked mid-2022 at a 6.1% high, Consumer Price Index (CPI) inflation was as high as 9%, effectively erasing those 6% gains. Instead of catching up, Americans have fallen further behind.

In short, much-discussed incremental improvements in economic indicators for prices and labor fall short of capturing the everyday experience of American consumers and workers. Many continue to feel the long-term effects of inflation and economic instability. With the present conditions of the economy and world, it is likely to remain that way in the foreseeable future.

[Yasmine VanDyke edited this piece]

The views expressed in this article are the author’s own and do not necessarily reflect Fair Observer’s editorial policy.

Support Fair Observer

We rely on your support for our independence, diversity and quality.

For more than 10 years, Fair Observer has been free, fair and independent. No billionaire owns us, no advertisers control us. We are a reader-supported nonprofit. Unlike many other publications, we keep our content free for readers regardless of where they live or whether they can afford to pay. We have no paywalls and no ads.

In the post-truth era of fake news, echo chambers and filter bubbles, we publish a plurality of perspectives from around the world. Anyone can publish with us, but everyone goes through a rigorous editorial process. So, you get fact-checked, well-reasoned content instead of noise.

We publish 2,500+ voices from 90+ countries. We also conduct education and training programs

on subjects ranging from digital media and journalism to writing and critical thinking. This

doesn’t come cheap. Servers, editors, trainers and web developers cost

money.

Please consider supporting us on a regular basis as a recurring donor or a

sustaining member.

Will you support FO’s journalism?

We rely on your support for our independence, diversity and quality.

Comment