Pakistan stands at a pivotal juncture in its energy journey, where persistent dependence on imported oil and gas collides with the promise of untapped domestic potential. New discoveries, seismic surveys and growing international interest point toward opportunities that could ease the country’s reliance on imports and enhance long-term energy security. At the same time, policymakers and industry leaders are exploring ways to channel investment into local resources while cultivating global partnerships to unlock this promise.

Rising domestic reserves: A glimpse of self-reliance

As of December 2024, Pakistan’s proven oil reserves stood at approximately 238 million barrels, representing a 23% increase from around 193 million barrels in December 2023. This growth, though modest in global terms, underscores the country’s latent potential and highlights the importance of sustained investment in domestic exploration. Despite this encouraging rise, domestic production still falls short of meeting national demand, keeping Pakistan reliant on imports to fuel its industries, transport and households.

The scale of this reliance is significant. In the fiscal year 2023–2024, Pakistan’s petroleum import bill reached $15.1 billion, according to the State Bank of Pakistan, while some sources reported a slightly higher figure of $16.9 billion.

This consistent outflow of foreign exchange underscores the importance of developing local reserves as a top priority. Every barrel produced domestically represents not just a saving in import costs, but also a step towards greater national resilience.

Shale energy: Pakistan’s untapped frontier

Beyond conventional oil and gas, Pakistan is among the world’s most promising nations in terms of shale energy potential. According to the US Energy Information Administration (EIA), Pakistan’s oil reserves are estimated at 353 million barrels, with oil and condensate production at around 60,000 barrels per day. These resources, largely concentrated in the Sembar and Ranikot formations of the Lower Indus Basin, could transform Pakistan’s energy profile if developed successfully.

It is important to note, however, that these remain geological assessments rather than proven reserves. Unlocking them would require extensive drilling, advanced technologies and a carefully phased development strategy. Industry estimates suggest that an initial investment of $5 billion or more, along with several years of effort, would be necessary before commercial-scale extraction becomes feasible.

Yet, this challenge also represents an opportunity. Pakistan has the chance to build partnerships with technologically advanced nations and multinational energy firms that can bring the expertise, capital and innovation needed to realize these resources. By positioning itself as an attractive investment destination, Pakistan could set the stage for a major transformation in its energy sector.

The Pakistan-US investment relationship holds untapped strategic value, particularly in critical sectors like minerals, energy, information technology (IT) and agriculture. Pakistan’s mineral reserves, valued between $6–8 trillion, including copper, lithium and rare earths, offer a strategic edge. These resources are crucial for the US clean energy transition and technological security.

The Special Investment Facilitation Council (SIFC) has been a pivotal enabler in streamlining procedures and boosting investment, especially in sectors like renewables and mining. US foreign direct investment (FDI) in Pakistan remains underutilized, with further engagement in energy development and mineral extraction critical for both countries’ long-term economic interests.

Offshore exploration: the next energy frontier

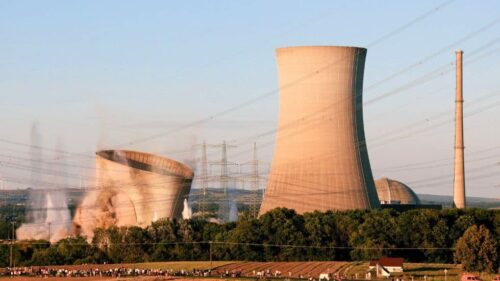

Momentum is also being built offshore. In early 2024, a multi-year seismic survey was conducted in the offshore Indus Basin, which detected promising subsurface structures containing hydrocarbons.

While still at an early stage, these findings suggest that Pakistan’s coastal regions may hold the key to future discoveries. Successful offshore exploration would not only diversify the energy mix but also elevate Pakistan’s status as a serious player in the global energy market.

These initiatives underline the fact that Pakistan is far from resource-poor; rather, it is a nation on the cusp of converting geological promise into economic strength. With the right strategies and partnerships, it could unlock reserves that support industrial growth, create jobs and stabilize its balance of payments.

Energy development cannot be viewed in isolation; it is deeply tied to Pakistan’s international partnerships. Since its independence in 1947, Pakistan’s relationship with the United States has been shaped by both geopolitical shifts and enduring economic cooperation. Despite ups and downs, the trade and investment relationship has proven resilient, with the US consistently ranking among Pakistan’s largest trading partners.

Today, the United States is not only Pakistan’s largest export market, accounting for about 17% of total exports, but also a leading source of foreign direct investment. US companies have been active in consumer goods, information and communications technology (ICT), renewable energy and financial services, bringing global expertise and creating local opportunities. Pakistan, in turn, has exported textiles, apparel and a growing range of goods to the US, cementing the bilateral trade corridor as one of the most important in South Asia.

The momentum has accelerated further in recent months. In July–August 2025, high-level talks culminated in a new trade agreement aimed at developing Pakistan’s oil reserves and reducing bilateral tariffs. The accord promises not only to deepen cooperation in hydrocarbons but also to expand market access for Pakistani exports.

US President Donald Trump even suggested that future exploration could position Pakistan as an energy exporter to regional markets such as India — an ambitious but symbolic indicator of Pakistan’s potential.

Toward an energy-independent future

Pakistan’s energy challenge is undeniable, but so too is its potential. Rising proven reserves, significant shale prospects and encouraging offshore surveys highlight a future that could be shaped by reform, innovation and foreign investment.

For partners like the United States, deeper engagement in Pakistan’s energy sector is not only an economic opportunity but also a strategic investment in regional stability. If managed wisely, Pakistan could move from chronic dependency toward becoming a more resilient, self-sufficient player in the global energy landscape.

[Patrick Bodovitz edited this piece.]

The views expressed in this article are the author’s own and do not necessarily reflect Fair Observer’s editorial policy.

Support Fair Observer

We rely on your support for our independence, diversity and quality.

For more than 10 years, Fair Observer has been free, fair and independent. No billionaire owns us, no advertisers control us. We are a reader-supported nonprofit. Unlike many other publications, we keep our content free for readers regardless of where they live or whether they can afford to pay. We have no paywalls and no ads.

In the post-truth era of fake news, echo chambers and filter bubbles, we publish a plurality of perspectives from around the world. Anyone can publish with us, but everyone goes through a rigorous editorial process. So, you get fact-checked, well-reasoned content instead of noise.

We publish 3,000+ voices from 90+ countries. We also conduct education and training programs

on subjects ranging from digital media and journalism to writing and critical thinking. This

doesn’t come cheap. Servers, editors, trainers and web developers cost

money.

Please consider supporting us on a regular basis as a recurring donor or a

sustaining member.

Will you support FO’s journalism?

We rely on your support for our independence, diversity and quality.

Comment

Where will Pakistan find the capital and technology to convert “geological promise into economic strength.” Venezuela offers a cautionary tale of a state that squandered its natural resources. I fear Pakistan is more likely to follow the Venezuela, not the Norway, model.